#Canada Wind Power Market Share

Explore tagged Tumblr posts

Text

Canada Wind Power Market: 4.63% CAGR Growth Expected by 2028

Canada Wind Power Market is expected to grow owing to growing public awareness and support for renewable energy, along with concerns about climate change throughout the forecast period.

According to TechSci Research report, “Canada Wind PowerMarket – By Region, Competition, Forecast and Opportunities, 2018-2028”, Canada Wind Power Market is expected to register robust growth during the forecast period. Government policies and incentives at both the federal and provincial levels play a significant role in driving the wind power market. Programs such as Renewable Portfolio Standards (RPS), Feed-in Tariffs (FIT), and tax incentives provide financial support and regulatory frameworks for wind energy projects.

The Canadian government and several provincial governments have set ambitious renewable energy targets and implemented policies to support the growth of wind power. These policies include Renewable Portfolio Standards (RPS), Feed-in Tariffs (FIT), and Renewable Energy Credits (RECs), which provide incentives and regulatory frameworks for wind energy projects.

Based on application, the Industrial segment is expected to dominate the market during the forecast period. The mining sector in Canada involves extracting various minerals and resources, such as metals, minerals, and fossil fuels. It often operates in remote locations with limited access to the grid. Wind power can be a viable solution for remote mining operations, where the cost of grid extension is prohibitive. Wind-diesel hybrid systems are increasingly used to power mining sites, reducing reliance on diesel generators. The mining industry's adoption of wind power aligns with its growing focus on environmental sustainability and reducing greenhouse gas emissions. Oher industries, such as forestry, oil and gas, and chemical processing, also utilize electricity for their operations. The adoption of wind power in these segments varies depending on factors like location, energy needs, and environmental goals.

Wind power can be an attractive option for industries looking to reduce their carbon footprint and reliance on fossil fuels. Many companies in these sectors are investing in renewable energy projects, including wind farms. Overall, the industrial segment in the Canadian Wind Power Market is diverse, with each industry having unique energy requirements and motivations for adopting wind power. The trend toward sustainability, environmental responsibility, and cost savings is driving increased adoption of wind energy across these industrial sectors, making it an essential component of Canada's clean energy transition. The growth of wind power in industrial applications is expected to continue as technology advances and renewable energy becomes more integrated into various sectors of the Canadian economy.

Browse over XX market data Figures spread through XX Pages and an in-depth TOC on the "Canada Wind Power Market." https://www.techsciresearch.com/report/canada-wind-power-market/22349.html

Based on Installation, the Offshore segment is projected to dominate the market throughout the forecast period. Offshore wind projects may benefit from energy storage solutions to ensure grid stability and manage the intermittent nature of wind generation. Battery technology and other storage options are increasingly integrated into offshore wind projects to optimize energy delivery. Building transmission infrastructure to connect offshore wind farms to the mainland is a significant consideration. The development of subsea cables and onshore substations is critical to deliver offshore wind-generated electricity to consumers. Offshore wind projects create jobs, stimulate local economies, and generate revenue through lease payments to coastal communities and local governments.

Engaging with local communities, including indigenous groups, is vital for offshore wind project development. Collaborative approaches and respect for traditional land and resource rights are key to gaining support and approval. As the Canadian offshore wind industry grows, there may be opportunities to export expertise and technology to international markets looking to develop their offshore wind sectors. In conclusion, the offshore segment of the Canada Wind Power Market represents a promising and evolving sector with considerable growth potential. Government support, abundant wind resources, and alignment with environmental and energy goals are driving offshore wind development, making it a vital component of Canada's renewable energy transition and efforts to reduce carbon emissions.

Key market players in the Canada Wind Power Market are:

Vestas Canadian Wind Technology

GE Renewable Energy Canada

Siemens Gamesa Renewable Energy

Suzlon Energy Canada

Boralex Inc

Brookfield Renewable Partners L.P

Innergex Renewable Energy Inc

TransAlta Renewables Inc

Northland Power Inc

Enercon Canada Inc

Download Free Sample Report https://www.techsciresearch.com/sample-report.aspx?cid=22349

Customers can also request for 10% free customization on this report.

“The Canada Wind Power Market in Alberta is poised to be the dominant force in the industry. Alberta boasts some of the best wind resources in Canada, particularly in southern and southwestern regions. These areas experience strong and consistent winds, making them ideal for wind power development. The availability of favorable wind resources is a key driver for the growth of the wind power sector in Alberta, attracting developers and investors.” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based global management consulting firm.

“Canada Wind Power Market Segmented By Application (Residential, Commercial and Industrial), By Installation (Onshore and Offshore), By Turbine Capacity (100 KW, 100 KW to 500 KW, 500 KW to 1 MW, 1MW to 3 MW and Less than 3 MW), By Region, and By Competition, 2018-2028,” has evaluated the future growth potential of Canada Wind Power Marketand provides statistics & information on market size, structure, and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in Canada Wind Power Market.

Browse Related Researchs

United States Onshore Floating Solar Market https://www.techsciresearch.com/report/united-states-onshore-floating-solar-market/21273.html United States Captive Power Generation Market https://www.techsciresearch.com/report/united-states-captive-power-generation-market/21372.html Saudi Arabia Solar Assisted Heat Pump Market https://www.techsciresearch.com/report/saudi-arabia-solar-assisted-heat-pump-market/21690.html

Contact Us-

TechSci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

M: +13322586602

Email: [email protected]

Website: www.techsciresearch.com

#Canada Wind Power Market#Canada Wind Power Market Size#Canada Wind Power Market Share#Canada Wind Power Market Trends#Canada Wind Power Market Growth

0 notes

Text

Support a Bold Vision for the Future of Energy Innovation

The Global Landscape of Energy: Trump, USA, Germany, and Canada’s Role in Shaping the Future

In today's world, the energy sector is one of the most crucial drivers of economic growth, technological innovation, and geopolitical influence. Countries like the United States, Germany, and Canada are at the forefront of this transformation, each playing a pivotal role in how energy is produced, consumed, and shared globally. Additionally, the leadership of former President Donald Trump has significantly impacted the United States' energy policies, affecting both domestic and international landscapes. This article delves into the key dynamics of Trump energy policies, USA energy strategies, and the energy frameworks of Germany and Canada.

Trump Energy Policies: Shaping the U.S. Energy Future

Under the leadership of Donald Trump, the United States experienced significant shifts in energy policies. Trump’s administration focused on reducing government intervention in the energy market, championing deregulation, and expanding fossil fuel production. One of his key moves was to withdraw from the Paris Climate Agreement, a decision that emphasized his stance on prioritizing domestic energy development over international climate commitments.

The Trump energy agenda was defined by an "America First" approach that encouraged the production of coal, oil, and natural gas. His policies sought to increase the nation’s energy independence by removing barriers for energy companies. This included easing environmental regulations for oil drilling, coal mining, and natural gas extraction. The administration also promoted the development of pipelines, such as the Keystone XL pipeline, which would transport oil from Canada to the U.S. This was in stark contrast to the environmental policies of his predecessors, which had focused more on renewable energy development and stricter emissions controls.

While Trump's energy policies were hailed by some for boosting U.S. energy production and creating jobs in the fossil fuel sector, they were criticized by others for their environmental implications. Critics argue that the focus on traditional energy sources undermined efforts to combat climate change and transition to cleaner, renewable energy solutions. Nonetheless, Trump's stance on energy undoubtedly shaped the landscape of U.S. energy production and consumption during his tenure.

USA Energy: A Diverse and Evolving Landscape

The energy landscape in the United States is as complex and diverse as the nation itself. The U.S. is one of the largest producers and consumers of energy globally, with a mix of fossil fuels, renewables, and nuclear energy forming the backbone of the energy sector. The nation has made significant strides in renewable energy, particularly solar and wind power, over the past two decades.

Despite the push for renewables, fossil fuels remain the dominant energy source in the U.S. Natural gas has become the primary energy resource due to advances in hydraulic fracturing (fracking), which has unlocked vast reserves of shale gas. The U.S. is now one of the world’s largest producers of natural gas, and this has had far-reaching effects on both domestic energy security and international trade.

At the same time, renewable energy in the U.S. continues to grow. Wind power, especially in states like Texas and Iowa, has seen substantial investments, while solar power has experienced exponential growth, thanks to federal tax incentives and decreasing technology costs. The Biden administration has placed a strong emphasis on decarbonizing the energy sector and increasing the adoption of electric vehicles, renewable energy sources, and energy efficiency technologies.

As the U.S. moves toward a more sustainable energy future, balancing the interests of fossil fuel industries with the demands of environmental policy remains a delicate challenge.

Germany Energy: A Pioneering Green Energy Model

Germany has long been a global leader in renewable energy, and its “Energiewende” or energy transition strategy has been a model for many nations looking to reduce carbon emissions and shift to sustainable energy sources. Germany's energy landscape is defined by its commitment to phasing out nuclear energy and dramatically increasing the use of wind, solar, and other renewable sources.

In 2011, following the Fukushima disaster in Japan, Germany made the bold decision to shut down all of its nuclear power plants by 2022. This decision prompted a major shift toward renewable energy sources, including wind, solar, and biomass. The country has become one of the world’s top producers of wind energy, with both onshore and offshore wind farms playing a significant role in its energy mix.

Germany’s commitment to reducing carbon emissions has spurred significant investments in green technologies. In 2020, over 45% of the country’s electricity was generated from renewable sources, making it one of the top countries globally in terms of renewable energy production. However, the transition has not been without challenges. The high cost of renewable energy infrastructure, as well as intermittent power generation from wind and solar, have posed obstacles. Nonetheless, Germany’s energy transition remains a cornerstone of its energy policy, with the country aiming to achieve carbon neutrality by 2045.

Canada Energy: Balancing Fossil Fuels with Sustainability

Canada’s energy sector is deeply intertwined with its vast natural resources. As one of the world's largest producers of oil, Canada’s energy sector is heavily reliant on fossil fuels, particularly oil sands in Alberta. However, Canada is also a global leader in hydropower generation, with renewable energy accounting for a significant portion of its energy mix.

In terms of fossil fuels, Canada is one of the largest exporters of oil and natural gas, primarily to the United States. The country’s energy policies are often shaped by the need to balance economic growth from fossil fuel exports with increasing pressure to address climate change. Canada has faced significant challenges in managing the environmental impact of its oil sands operations, which have been linked to deforestation, water usage concerns, and high carbon emissions.

At the same time, Canada has made substantial investments in clean energy, particularly hydroelectric power, wind, and solar. The country is rich in natural resources for renewable energy, especially hydroelectricity, with massive dams such as the Churchill Falls generating electricity for both domestic use and export. Additionally, Canada’s vast forests and cold climate make it an ideal location for wind energy generation, and projects are continually expanding in areas like British Columbia and Quebec.

Canada’s energy future will likely depend on how well it can reconcile its traditional reliance on fossil fuels with the increasing demand for cleaner energy solutions. The country has committed to achieving net-zero emissions by 2050, which will require massive investments in clean energy infrastructure and a shift away from fossil fuels over the coming decades.

A Visionary Energy Future: Bridging the Gaps

The energy policies of the United States, Germany, and Canada illustrate the complex dynamics of global energy systems. While each country has its unique energy landscape, they all face similar challenges in balancing economic growth with environmental sustainability. Trump’s energy policies, with their emphasis on fossil fuels, represent one end of the spectrum, while Germany’s aggressive push for renewable energy reflects another. Canada, with its blend of fossil fuel resources and renewable potential, finds itself navigating a middle ground.

The future of energy lies in innovation and collaboration. With global energy demand continuing to rise, there is a clear need for new solutions to ensure energy security, environmental sustainability, and economic growth. The Visionary Energy Creation Initiative, a platform aimed at supporting sustainable energy projects, is one such effort to promote transformative energy solutions across borders. By investing in visionary technologies and fostering collaboration between nations, it is possible to create an energy future that benefits both people and the planet.

In conclusion, the energy policies of Trump, the USA, Germany, and Canada reflect diverse approaches to addressing the world's energy challenges. As each country continues to evolve its energy strategies, one thing is clear: the global shift toward sustainable energy is inevitable, and the collaboration between these nations will play a crucial role in shaping the future of energy worldwide.

0 notes

Text

Tapping into the Northern Lights Tourism Market: A Guide for Entrepreneurs

The global northern lights tourism market size is anticipated to reach USD 1,647.9 million by 2030 and is projected to grow at a CAGR of 9.8% from 2024 to 2030, according to a new report by Grand View Research, Inc. The Northern Lights, or aurora borealis, have long fascinated people with their mesmerizing displays of color across the polar skies. This natural phenomenon, driven by solar winds interacting with Earth’s atmosphere, has evolved from a niche interest into a booming global tourism sector. As the sun nears its Solar Maximum, expected to peak in 2024, this has further fueled interest, leading to an unprecedented surge in Northern Lights tourism. Travelers are increasingly prioritizing aurora chasing over other bucket-list experiences, evident in the soaring demand and trip searches.

Countries within or near the Arctic Circle, including Norway, Finland, Canada, and Iceland, are experiencing a significant boost in tourism due to the Northern Lights. Recent data reveals dramatic growth in accommodation and travel metrics in these regions, reflecting a 217% increase in Arctic Circle stays in Nordic countries between 2009 and 2016.

The upcoming Solar Maximum is anticipated to enhance the visibility and intensity of the auroras, making 2024 and 2025 prime years for aurora enthusiasts. Countries like Finland and Norway are seeing a significant rise in searches and bookings, with Finland’s Lapland region witnessing a 370% increase in hotel searches. Canada’s Churchill and Norway’s Alta are also among the top destinations, reflecting a broader trend towards seeking unique, natural spectacles as part of travel experiences.

Currently, the Northern Lights tourism industry is booming, with increasing investment in local infrastructure and services to cater to the rising number of visitors. For example, Finnair is expanding its capacity to Lapland, and Icelandair’s Northern Lights campaign saw a notable increase in passengers. In Norway, Tromsø is experiencing a tourism revival, with a 10% rise in industry revenue and a significant increase in the number of international guests, demonstrating the growing economic impact of aurora-driven travel.

Despite the booming interest, challenges remain, including rising costs and infrastructure limitations in some regions. Kirkenes, Norway, for instance, struggles with inadequate hotel capacity and power supply issues. Nevertheless, the overall trend indicates a flourishing industry driven by the allure of the Northern Lights. As travel continues to seek unique and awe-inspiring experiences, the auroras remain a shining beacon in the global tourism landscape.

Northern Lights Tourism Market Report Highlights

Based on age group, the 18-34 years segment led the market with the largest revenue share of 31.56% in 2023. Trips to witness the northern lights align perfectly with Gen Z's preferences for enchanting natural scenery and unique experiences. This generation prioritizes destinations with stunning natural beauty and authentic local experiences over nightlife and entertainment

Based on traveler type, the friends segment is expected to grow at a significant CAGR from 2024 to 2030. The journey offers opportunities for collaborative planning and overcoming challenges together, enhancing teamwork and mutual support. Experiencing new cultures and environments collectively broadens perspectives and fosters deeper connections

Europe dominated the market with the largest revenue share of 45.48% in 2023. The market here is set to rise due to recent spectacular displays caused by the strongest solar storm in over 20 years, which made the auroras visible as far south as southern England

Northern Lights Tourism Market Segmentation

Grand View Research has segmented the global northern lights tourism market report based on traveler type, age group, and region:

Northern Light Tourism Traveler Type Outlook (Revenue, USD Million, 2018 - 2030)

Couple

Friends

Family

Solo

Northern Light Tourism Age Group Outlook (Revenue, USD Million, 2018 - 2030)

18-34 Years

35-49 Years

50-64 Years

65+ Years

Northern Light Tourism Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Denmark

Sweden

Norway

Iceland

Finland

Asia Pacific

Japan

China

India

Australia

Central & South America

Brazil

Middle East & Africa

South Africa

Key Players in the Northern Lights Tourism Market

Abercrombie & Kent

Quark Expeditions

Scott Dunn

Exodus Travels

Intrepid Travels

Hurtigruten Expeditions

Butterfield & Robinson Inc.

Lindblad Expeditions

Travel Edge

The Aurora Zone

Order a free sample PDF of the Northern Lights Tourism Market Intelligence Study, published by Grand View Research.

0 notes

Text

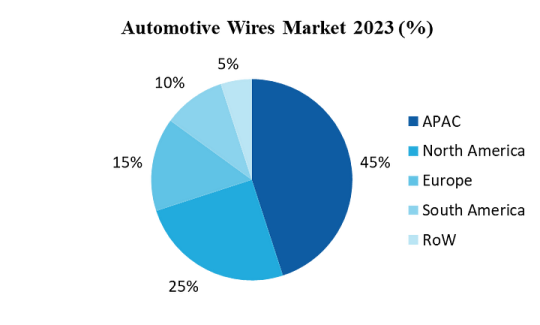

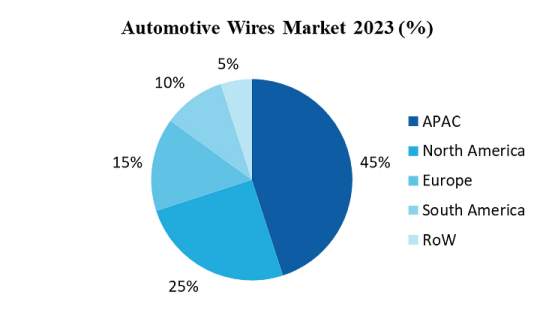

Automotive Wires Market- Opportunity Analysis & Industry Forecast, 2024–2030

Automotive Wires Market Overview:

Request sample :

Automotive wire demand is expected to rise due to the growing trend of lightweight passenger automobiles as a means of reducing carbon emissions. In response to stringent regulations aimed at reducing carbon emissions from automobiles, manufactures will concentrate on producing aluminium automotive wires to reduce the vehicle’s overall weight. This is going to help in achieving the new regulations criteria. The rising focus on enhancing the standards for automotive wire will give opportunities for market expansion. For instance, according to US Auto Outlook 2024, light vehicle sales to grow 3.7% above last year’s level, rising to 16.1 million units. Additionally, the demand for automotive wires is expected to rise in parallel with the volume of vehicles being produced and the increasing demand from customers for better comfort, safety, and convenience.

Market Snapshot

Automotives Wires Market — Report Coverage:

The “Automotive Wires Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Automotives Wires Market.

AttributeSegment

By Material

· Copper

· Aluminium

· Others

By Vehicle Type

· Passenger Vehicles

· Light Commercial Vehicles

· Heavy Commercial Vehicles

By Propulsion

· ICE Vehicles

· Hybrid Vehicles

· Pure Electric Vehicles

By Transmission Type

· Electric wiring

· Data Transmission

By Application

· Engine wires

· Chassis wires

· Body and Lighting wires

· HVAC wires

· Dashboard / Cabin wires

· Battery wires

· Sensor wires

· Others

By End User

· OEM

· Aftermarket

By Geography

· North America (U.S., Canada and Mexico)

· Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe),

· Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific),

· South America (Brazil, Argentina, Chile, Colombia and Rest of South America)

· Rest of the World (Middle East and Africa).

Inquiry Before Buying:

COVID-19 / Ukraine Crisis — Impact Analysis:

The COVID-19 pandemic disrupted global supply chains, leading to delays in production and sales of automobiles which led to decrease in automotive wire manufacturing. Governments worldwide imposed lockdowns and restrictions, which led to shut down of mines, factories, and transportation networks, thus disrupting the supply of raw materials such as copper and aluminum, that are used in making automotive wires.

The Russia-Ukraine war had a huge impact on the global automotive wires market. Ukraine is a major manufacturer of copper, a material used as an automotive wiring component. The war has led to mining disruptions, which in turn has caused the shortages and increase in prices globally.

Key Takeaways:

Copper wires segment is Leading the Market

Copper wires segment holds the largest share in the automotive wires market with respect to market segmentation by material. Electrification will be the biggest driver to copper demand for vehicles. Copper is used throughout electric vehicle powertrains, from foils in each cell of the battery to the windings of an electric motor. In total, each electric vehicle can generate over 30kg of additional copper demand. According to a report by IDTechEx, the demand for copper from the automotive industry was just over 3MT in 2023 but is set to increase to 5MT in 2034. Because of its electrical and chemical characteristics, copper is used in every part of the battery. There are lot of tiny cells in the battery, and each one has a copper foil to carry electricity out of the cell. Large copper bars placed throughout the battery also convey the energy from each cell to the high-voltage connections, which in turn power the motor and electronics. Such parts and components with the copper are driving the market growth of copper wires in automotive wires market.

Passenger Vehicles are Leading the Market

Passenger Vehicles segment is leading the Automotive Wires Market by Application. The passenger vehicle category is currently holding the largest share in the automotive wires market because of a combination of factors including large production volumes, a wide range of wiring requirements, technological developments, and the increasing adoption of electric vehicles. For instance, according to Global and EU Auto industry 2023 report by The European Automobile Manufacturers’ Association (ACEA), European car production grew substantially, reaching nearly 15 million units, marking a significant year-on-year improvement of 12.6%. The growing popularity of electric vehicles (EVs) is also contributing to the growth of the passenger vehicle segment in the automotive wires market. EVs have more complex wiring systems due to the integration of batteries, motors, and charging infrastructure.

Schedule A Call :

Integration of Smart Systems in Automobiles

Global demand for automotive wires is primarily driven by the integration of smart systems in automobiles. Modern automobiles have more wires because electronic control units (ECUs) are becoming more and more popular. Each ECU has been connected to a variety of sensors, actuators, and other ECUs through a complex network of connections. Automotive manufacturers are using sophisticated wiring solutions, such as light-weight harnesses, insulated cables and high-temperature-resistant wires to manage the rising number of connections and ensure reliable performance. For instance, In July 2024, Compal Electronics Inc, a leading contract electronics manufacturer from Taiwan, announced plans to build its first European factory in Poland. The company intends to invest more than $15.4 million to target automotive electronics clients. This strategic move marks Compal’s expansion into the European market. The need for complex and more advanced wiring solutions will continue to grow as automobiles become more technologically advanced, fueling the worldwide automotive wires market’s expansion.

Buy Now :

Fluctuating cost of materials to hamper the market

For more details on this report — Request for Sample

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships, and collaborations are key strategies adopted by players in the Automotive Wires Market. The top 10 companies in this industry are listed below:

Aptiv plc

Yazaki Corporation

Furukawa Electric Co., Ltd

Sumitomo wiring systems

Nexans SA

Fujikura Ltd

Samvardhana Motherson International Ltd

Leoni AG

Lear Corporation

THB Electronics

Scope of the Report:

Report MetricDetails

Base Year Considered

2023

Forecast Period

2024–2030

CAGR

5.7%

Market Size in 2030

$ 6.8 Billion

Segments Covered

By Material, By Vehicle Type, By Propulsion, By Transmission Type, By Application, By End User and By Geography.

Geographies Covered

North America (U.S., Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia and Rest of South America), Rest of the World (Middle East and Africa).

Key Market Players

1. Aptiv plc

2. Yazaki Corporation

3. Furukawa Electric Co., Ltd

4. Sumitomo wiring systems

5. Nexans SA

6. Fujikura Ltd

7. Samvardhana Motherson International Ltd

8. Leoni AG

9. Lear Corporation

10. THB Electronics

For more Automotive Market reports, please click here

0 notes

Text

The Economics of Wind Turbine Decommissioning: Cost Factors and Market Growth

The global wind turbine decommissioning market is poised for robust growth in the coming years, fueled by increasing investments in renewable energy, ambitious national energy targets, and advancements in wind power technologies. With governments and corporations worldwide focusing on environmentally sustainable energy solutions, the need for effective wind turbine decommissioning services is becoming increasingly critical.

Wind turbine decommissioning involves the complete removal of wind turbines from service and the restoration of land to its original condition. As wind turbines reach the end of their lifecycle, owners must choose between decommissioning or repowering their facilities. Decommissioning often entails the disassembly of turbines, disposal of non-recyclable components, and restoration of the site. This ensures environmental compliance and prepares the land for alternative uses.

The demand for wind turbine decommissioning services is driven by the difficulty in replacing aging turbine components and the high cost of maintaining deteriorating parts. Furthermore, as power purchase agreements conclude, the business case for operating aging wind turbines diminishes, prompting the need for decommissioning.

Visit our report to explore critical insights and analysis - https://www.transparencymarketresearch.com/wind-turbine-decommissioning-market.html

Key Market Drivers

Technological Advancements and Cost Efficiency Innovations in wind power systems have improved energy generation efficiency while reducing the Levelized Cost of Energy (LCOE). These advancements have enhanced the economic viability of decommissioning services, bolstering market demand.

Shift Towards Renewable Energy With the global transition to renewable energy sources, such as wind, solar, and geothermal, investments in sustainable energy infrastructure are surging. This shift is expected to significantly boost the wind turbine decommissioning market in the near future.

Supportive Government Policies National targets, international agreements, and government subsidies aimed at promoting renewable energy have created a favorable environment for the growth of wind turbine decommissioning services.

Regional Insights

Europe is expected to dominate the global wind turbine decommissioning market, driven by substantial investments in renewable energy and its leadership in offshore wind energy. In 2018 alone, Europe decommissioned 421 megawatts of wind power, with Germany accounting for the largest share. The region’s commitment to setting global standards for decommissioning practices positions it as a key player in the market.

The U.S. wind turbine decommissioning market is also projected to experience significant growth, supported by federal tax incentives and state-level renewable energy policies. Meanwhile, the Middle East and Africa are emerging as potential markets, with governments focusing on reducing fossil fuel dependency and promoting clean energy solutions.

Contact Us: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Green Hydrogen Market Trends: Growth and Opportunities Through 2024-2033

Hydrogen itself is a versatile energy carrier, and it can be produced through various methods. Green hydrogen refers to hydrogen that is produced using renewable energy sources, such as wind, solar, or hydroelectric power, through a process called electrolysis.

The global Green hydrogen market was valued at $828.2 million in 2023, and it is expected to grow with a CAGR of 67.19% during the forecast period 2023-2033 to reach $141.29 billion by 2033.

Green Hydrogen Overview

Green hydrogen represents a significant breakthrough in the field of renewable energy and sustainability. It is a form of hydrogen gas produced using renewable energy sources, distinguishing it from grey or blue hydrogen, which are derived from fossil fuels. The primary method for producing green hydrogen is through the electrolysis of water, a process that utilizes electricity generated from renewable sources such as wind, solar, or hydropower to split water into hydrogen and oxygen.

Request a free sample report of the Green Hydrogen Market Trends

The Growing Market for Green Hydrogen - Market Demand Drivers

Decarbonization Targets- Many countries have set ambitious net-zero emissions goals, with hydrogen seen as a critical solution to decarbonize sectors that are hard to electrify, such as heavy industry, shipping, and aviation.

Advances in Technology- The cost of producing green hydrogen through electrolysis has been steadily decreasing due to advancements in renewable energy technologies and electrolyzer efficiency.

Corporate Commitments- Major corporations, particularly in the energy, transportation, and industrial sectors, are committing to using green hydrogen as part of their sustainability strategies.

Government Supports and Policy Incentives- Governments worldwide are creating policies and providing incentives to promote the use of green hydrogen.

Download Complete TOC of the Green Hydrogen Market Trends

Green Hydrogen Market Segmentation

1 By Application

Oil and Gas

Industrial Feedstock

Mobility

Power Generation

Industrial Feedstock Application to Dominate Global Green Hydrogen Market

2 By Technology

Proton Exchange Membrane (PEM) Electrolyzer Alkaline Electrolyzer Anion Exchange Membrane Solid Oxide Electrolyzer

Alkaline Electrolyzer to Lead the Global Green Hydrogen Market (by Technology)

3 By Renewable Energy Source

Wind Energy

Solar Energy

Others

Solar Energy to Hold Highest Share in Global Green Hydrogen Market

4 By Region

• North America - U.S., Canada, and Mexico

• Europe - France, Germany, U.K., Spain, Italy, Russia, and Rest-of-Europe

• Asia-Pacific - China, India, Japan, Australia, South Korea, and Rest-of-Asia-Pacific

• Rest-of-the-World (ROW)

Get more market insights on Advanced materials and chemicals

Key Market Players

Linde plc

Air Liquide

Air Products and Chemicals, Inc.

Engie

Uniper SE

Siemens Energy

Green Hydrogen Systems

Cummins Inc.

Recent Developments

• In 2023, Linde plc announced plans to increase green hydrogen production capacity in California, responding to growing demand from the mobility market.

• In February 2021, Air Liquide and Siemens Energy signed a memorandum of understanding with the objective of combining their expertise in proton exchange membrane (PEM) electrolysis technology. In this collaboration, both companies intend to focus their activities on key areas such as the co-creation of large industrial-scale hydrogen projects in collaboration with customers, laying the ground for manufacturing electrolyzers at large scale in Europe, especially in Germany and France, and R&D activities to co-develop next-generation electrolyzer technologies.

Conclusion

The Green Hydrogen Market stands at a pivotal point in its development, driven by the urgent need to address climate change and the global push toward sustainable energy. As countries, industries, and consumers prioritize decarbonization, green hydrogen has emerged as a key solution for achieving net-zero emissions, particularly in sectors that are challenging to electrify, such as heavy industry, transportation, and power generation.

With a combination of technological advancements, declining renewable energy costs, and strong government policies, the market for green hydrogen is poised for significant growth. The expanding role of corporate sustainability commitments, coupled with increased investment and international collaboration, is further accelerating the transition toward a hydrogen-powered economy.

0 notes

Text

Wire & Cable Market Size, Share & Trends Analysis Report By Type By End-use, By Region, And Segment Forecasts, 2024 – 2034

The Wire & Cable Market is a critical segment of the global electrical and electronics industry. It encompasses a wide range of products, including power cables, communication cables, and specialty cables, used in various applications across industries like energy, telecommunications, automotive, construction, and electronics.

It is anticipated that the worldwide wire and cable market will expand at a compound annual growth rate (CAGR) of 3.8% between 2024 and 2034. The market is projected to reach USD 302.35 billion in 2034 based on an average growth pattern. It is anticipated that the global wire and cable sector will produce USD 233.59 billion by 2024.

Get a Sample Copy of Report, Click Here: https://wemarketresearch.com/reports/request-free-sample-pdf/wire-and-cable-market/1611

Key Drivers

Infrastructure Development

Rapid urbanization and investments in infrastructure projects, such as smart cities and power grids, are boosting demand.

Electrification initiatives in rural and underdeveloped regions drive growth in developing countries.

Energy Demand and Renewable Integration

Rising electricity consumption and the integration of renewable energy sources like solar and wind require advanced transmission and distribution systems.

High-voltage and extra-high-voltage cables are in high demand for efficient power distribution.

Telecommunication and Data Centers

Expansion of 5G networks and data centers is accelerating the need for high-performance fiber optic and coaxial cables.

Automotive Industry

The shift toward electric vehicles (EVs) increases the demand for specialized cables for batteries and charging infrastructure.

Challenges

Raw Material Price Fluctuations: Copper and aluminum, primary materials for cables, are subject to price volatility, impacting manufacturing costs.

Counterfeit Products: The proliferation of low-quality, counterfeit cables hampers market trust.

Environmental Concerns: Producing and disposing of certain cable materials raises environmental sustainability issues.

Market Trends

Technological Advancements

The emergence of smart cables with embedded sensors for real-time data transmission.

Increased adoption of eco-friendly cables made from recyclable materials.

Focus on Energy Efficiency

Development of low-loss and high-temperature cables to enhance energy efficiency.

Wire & Cable Market Segmentation,

By Cable Type

Low Voltage Energy Cables

Power Cables

Fiber Optic Cables

Signal & Control Cables

Others

By Installation

Overhead

Underground

Submarine

By Voltage

Low Voltage

Medium Voltage

High Voltage

Extra High Voltage

By End-Use Industry

Aerospace & Defense

Building & Construction

Oil & Gas

Energy & Power

IT & Telecommunication

Automotive

Others

Key companies profiled in this research study are,

The Global Wire & Cable Market is dominated by a few large companies, such as

Prysmian Group

Southwire Company, LLC

Nexans

Prysmian Group

Leoni AG

Sumitomo Electric Industries, Ltd.

Furukawa Electric Co., Ltd.

LS Cable & System Ltd.

Incab

Kabel Deutschland GmbH

Turktelekom

Belden Inc.

Amphenol Corporation

Helukabel GmbH

Nexans Cabling Solutions

Wire & Cable Industry: Regional Analysis

Forecast for the North American Market

Increased investments in renewable energy, especially in wind and solar projects in the US and Canada, are predicted to propel North America's rapid growth. The demand from industries like electronics, industrial machinery, and automobiles is one of the primary drivers of the region's growth. Initiatives to lower blackout losses and ongoing improvements to the infrastructure supporting the transmission of power have also aided in the growth of the market.

Forecast for the European Market

Europe is a significant player in the market as well, because to rising infrastructure spending for renewable energy sources and the need to improve the continent's electrical infrastructure. Due to two industries—industrial machinery and IT services—the region's need for wires and cables has been steadily growing. Specialized power lines are becoming more and more necessary as a result of the region's emphasis on smart grid technologies and high-voltage direct current (HVDC) systems. Fiber-optic cables as well as signal and control connections are becoming more and more crucial as 5G networks are being deployed in key European nations including Germany, France, and the UK.

Forecasts for the Asia Pacific Market

With almost 40% of the market, Asia Pacific is the biggest market for wire and cable. A variety of cables, such as fiber-optic, electricity, and low-voltage energy cables, are becoming more and more necessary due to the significant infrastructure development taking place in nations like China, India, and Japan. Particularly in China, the world's largest producer of solar and wind energy, significant investments are being made in power generating and renewable energy projects as the region's need for electricity rises. Fiber-optic cables and signal and control cables are in high demand due to the Asia-Pacific 5G rollout.

Conclusion

The Wire & Cable Market plays a vital role in enabling global connectivity and powering various industries. With the rapid advancements in technology, increasing energy demands, and the push toward renewable energy integration, the market is poised for sustained growth. While challenges such as raw material price volatility and environmental concerns persist, the industry's focus on innovation and sustainability is driving transformative changes. As infrastructure projects and electric vehicle adoption continue to rise, the demand for efficient, durable, and eco-friendly cable solutions will propel the market forward, making it an indispensable component of modern development.

0 notes

Text

An In-Depth Look at the Growth of North America Iron Casting Market

The North America iron casting market size is expected to reach USD 24.89 billion by 2030, expanding at a CAGR of 5.6% from 2023 to 2030, according to a new report by Grand View Research, Inc. The increasing number of projects related to sanitization, sewage, and wastewater treatment being carried out in North America is expected to fuel the growth of iron casting in the region in the coming years.

For instance, in July 2022, the governments of Canada and Nunavut announced an investment for the development of wastewater and water treatment plants in Nunavut. The Government of Canada is anticipated to invest approximately CAD 2.7 million (~USD 1.96 million) and the Government of Nunavut is providing approximately CAD 925,000 (~USD 671,082) for the development of these plants.

Based on product, the market is segmented into gray, ductile, and malleable. Ductile cast iron, also known as nodular iron or spherical graphite iron, has a composition similar to gray with graphite particles precipitated in spherical form rather than in the flake form. Unlike graphite flakes, there is no crack-like network created by the spherical graphite particles, which results in higher toughness and strength of ductile compared to gray cast iron.

Based on application, power generation is anticipated to register a growth rate of 6.4%, in terms of revenue, over the forecast period. Growing investments in renewable energy for power generation are anticipated to augment the demand for iron castings in the segment. For instance, in October 2021, the U.S. government decided to invest in expanding offshore wind energy. The wind farm is part of the government’s plan to generate 30 gigawatts of wind power by 2030.

Gather more insights about the market drivers, restrains and growth of the North America Iron Casting Market

North America Iron Casting Market Report Highlights

• Based on product, gray cast iron accounted for a volume share of over 62.0% in 2022 of the overall market. It is a commonly used material for developing products in various applications such as automotive, machinery & tools, and pipes, owing to its high compressive strength, and good damping capacity.

• Based on application, the pipes and fittings segment is expected to expand at a CAGR of 5.5%, in terms of revenue, from 2023 to 2030. Rising investments in various countries towards upgradation in infrastructure related to sanitization, sewage, and wastewater treatment are propelling segment growth.

• The railways segment is expected to register a CAGR of automotive 6.5% in terms of revenue across the forecast period. Iron castings find use in bearing adapters, rail tracks, suspensions, track connection plates, etc. Rising investments in the industry are anticipated to further augment segment growth over the coming years.

• Based on region, the U.S. is expected to register a CAGR of 4.6%, in terms of volume, over the forecast period. Increasing investment in the construction & infrastructure industry and rising demand for renewables are driving the market growth.

North America Iron Casting Market Segmentation

Grand View Research has segmented the North America iron casting market based on product, application, and region:

North America Iron Casting Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

• Gray Cast Iron

• Ductile Cast Iron

• Malleable Cast Iron

North America Iron Casting Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

• Automotive

• Machinery & Tools

• Pipes & Fitting

• Railways

• Power Generation

• Others

North America Iron Casting Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

Order a free sample PDF of the North America Iron Casting Market Intelligence Study, published by Grand View Research.

#North America Iron Casting Market#North America Iron Casting Market Analysis#North America Iron Casting Market Report#North America Iron Casting Market Size#North America Iron Casting Market Share

0 notes

Text

Power to Gas Market: Enhancing Renewable Energy Storage Solutions

The Power to Gas Market size was valued at USD 43.38million in 2023 and is expected to reach USD 83.16 million by 2032 with a growing CAGR of 10.2% over the forecast period of 2024–2032.

Market Overview

Power-to-gas technology enables the conversion of surplus renewable electricity into gas — typically hydrogen or methane — that can be stored, transported, and utilized across various applications. This technology helps address the intermittency of renewable energy sources like wind and solar, providing a stable and reliable energy supply and enhancing grid stability. Additionally, PtG offers a clean, efficient method for decarbonizing sectors such as industry and transportation by supplying green hydrogen for fuel cells and synthetic natural gas for heating systems.

Key Market Segmentation

The Power to Gas Market is segmented by technology, capacity, end-user, and region, providing targeted insights into market trends and growth opportunities.

By Technology

Methanation: Involves converting hydrogen and carbon dioxide into methane, which can be stored or used as synthetic natural gas. Methanation is gaining traction for its compatibility with existing gas infrastructure, enabling the storage and transport of renewable energy.

Electrolysis: Splits water into hydrogen and oxygen using renewable electricity, producing green hydrogen. Electrolysis has become the preferred method for hydrogen production due to its potential for scaling up and integration with various renewable sources, especially solar and wind.

Electrolysis currently dominates the market as it plays a vital role in producing green hydrogen, an essential fuel for decarbonizing energy-intensive sectors.

By Capacity

Less than 100 kW: Suitable for small-scale applications, including residential and small commercial setups.

100–999 kW: Commonly used for moderate-sized facilities, providing power to commercial and smaller utility systems.

1000 kW: Large-scale applications that support industrial processes and substantial energy storage needs.

More than 1000 kW: Used in large utility projects, capable of delivering significant storage and power output, often integrated with renewable energy farms.

Large-scale projects with capacities of 1000 kW or more are seeing increased investment as utility companies and industrial users seek efficient methods for large-volume energy storage and grid balancing.

By End-user

Commercial: PtG technology is increasingly utilized in commercial applications, offering a means for businesses to reduce energy costs and carbon emissions while benefiting from cleaner energy sources.

Residential: Small-scale power-to-gas systems are gaining attention for residential energy storage, providing homeowners with a sustainable solution for excess renewable energy.

Utility: Utilities are the primary adopters of PtG technology, leveraging it for large-scale storage and to ensure grid stability. Utilities also benefit from hydrogen as a flexible, long-term energy carrier for use during high-demand periods.

The utility sector holds the largest market share, as PtG solutions play a crucial role in energy storage, grid management, and renewable energy integration for utility companies worldwide.

Regional Analysis

The Power to Gas Market is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Europe: Europe leads the global market, with countries such as Germany, France, and the Netherlands investing heavily in PtG infrastructure as part of their commitment to reduce carbon emissions. European governments are supportive of PtG technology, seeing it as essential for achieving energy targets set by the European Green Deal and the Paris Agreement.

North America: In North America, the market is driven by increasing investments in green hydrogen, particularly in the United States and Canada. The US is actively supporting hydrogen initiatives through policy incentives and pilot projects, enhancing the region’s PtG market potential.

Asia-Pacific: Asia-Pacific is expected to see rapid growth, with countries like Japan, South Korea, and Australia investing in hydrogen infrastructure and renewable energy. These countries are focusing on PtG as part of their strategies to decrease reliance on fossil fuels and transition to renewable energy sources.

Latin America: The region is witnessing an increase in renewable energy capacity, and PtG offers a means for energy storage and integration, especially in countries like Brazil and Chile.

Middle East & Africa: Although at an early stage, the region is exploring PtG technology to harness its renewable potential, especially in areas with abundant solar resources. PtG can support the region’s renewable energy goals and reduce reliance on conventional energy sources.

Market Trends and Opportunities

Focus on Renewable Energy Integration: PtG provides a pathway to integrate excess renewable energy by converting it into gas, which can be stored or transported. This is especially valuable in regions with high renewable capacity but limited energy storage options.

Growing Adoption of Green Hydrogen: Green hydrogen, produced through electrolysis, is gaining prominence for its potential to decarbonize hard-to-abate sectors like transportation and heavy industry. Increasing interest in green hydrogen is bolstering the PtG market, particularly in regions with progressive environmental policies.

Development of Hydrogen Infrastructure: Expanding hydrogen infrastructure is a key factor driving PtG adoption. As countries invest in hydrogen refueling stations and transport networks, PtG technology will play a significant role in supplying clean hydrogen.

Policy Support and Subsidies: Governments worldwide are providing incentives, subsidies, and research grants for power-to-gas projects as part of their climate change mitigation strategies. Supportive policies are fostering market growth, especially in Europe, North America, and parts of Asia.

Technological Advancements in Electrolysis: Advancements in electrolysis, such as solid oxide and proton exchange membrane (PEM) technologies, are improving the efficiency of PtG systems. These innovations are making PtG more commercially viable, particularly for utility-scale projects.

Key Players

The major key players are Electrochaea, Carbotech, McPhy Energy, Exytron, Avacon, ITM Power, Aquahydrex, MAN Energy Solutions, Nel Hydrogen, Fuel Cell Energy, Hydrogenic, Green Hydrogen, Siemens AG, ThyssenKrupp

Conclusion

The Power to Gas Market is on a strong growth trajectory, driven by the urgent need for clean energy storage solutions and the global commitment to reducing carbon emissions. As PtG technology continues to advance and gain policy support, it is poised to become an integral part of energy infrastructure worldwide. By enabling the effective use of surplus renewable energy and producing green hydrogen, PtG will play a vital role in the global transition to sustainable energy systems.

Read Complete Report Details of Power to Gas Market: https://www.snsinsider.com/reports/power-to-gas-market-3098

About Us:

SNS Insider is a global leader in market research and consulting, shaping the future of the industry. Our mission is to empower clients with the insights they need to thrive in dynamic environments. Utilizing advanced methodologies such as surveys, video interviews, and focus groups, we provide up-to-date, accurate market intelligence and consumer insights, ensuring you make confident, informed decisions.

Contact Us: Akash Anand — Head of Business Development & Strategy [email protected] Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

0 notes

Text

Friday, November 22, 2024

Bomb Cyclone Hits Northwest (1440) Two people have died in Seattle, as a bomb cyclone impacts the Pacific Northwest. Nearly 600,000 customers have lost power. A bomb cyclone occurs when a storm system undergoes bombogenesis, with its central pressure dropping rapidly within 24 hours. This particular storm system has been fueled by an atmospheric river, a band of moisture in the sky with water vapor levels comparable to average flow levels at the mouth of the Mississippi River. The resulting weather system has unleashed hurricane-level winds in parts of Oregon and Canada, with Vancouver Island witnessing winds as high as 101 mph—the equivalent of a Category 2 storm. Heavy winds, rain, and snow are expected to continue impacting the region in the coming days. A separate storm is due to hit the Northwest as the current storm moves east.

How Trump’s tariffs could spark a trade war and ‘Europe’s worst economic nightmare’ (Washington Post) The prospect of a trade war ignited by the Trump administration is looming over European capitals. The European Union—which counts the United States as its largest export market and one of its closest strategic allies—could be among those hardest hit if President-elect Donald Trump follows through on his tariff plans. Already, Europe’s major economies are lagging behind the United States in their post-pandemic recovery. Economists say that protectionist policies imposed by Trump after taking office in January could trigger further contraction on the continent, while straining alliances. There is talk of “Europe’s worst economic nightmare” and “full-blown recession.” Some economic models estimate that, faced with an across-the-board 10 percent tariff, euro zone exports to the United States could fall by nearly a third. That would be a big deal, because Europe is so export-dependent, and its largest economies are already facing sluggish growth and rising debt. Goldman Sachs calculates that trade conflict with the United States could subtract 0.9 percent from the euro zone economy.

How Science Lost America’s Trust and Surrendered Health Policy to Skeptics (WSJ) The rise of Robert F. Kennedy Jr. from fringe figure to the prospective head of U.S. health policy was fueled by skepticism and distrust of the medical establishment—views that went viral in the Covid-19 pandemic. Lingering resentment over pandemic restrictions helped Kennedy and his “Make America Healthy Again” campaign draw people from the left and the right, voters who worried about the contamination of food, water and medicine. Many of them shared doubts about vaccines and felt their concerns were ignored by experts or regarded as ignorant. Doctors, scientists and public-health officials are asking themselves how they can win public trust back. Among their postelection revelations: Don’t underestimate or talk down to those without a medical degree. Much of Kennedy’s popularity reflects residual pandemic anger—over being told to stay at home or to wear masks; the extended closure of schools and businesses; and vaccine requirements to attend classes, board a plane or eat at a restaurant. “We weren’t really considering the consequences in communities that were not New York City,” the places where the virus wasn’t hitting as hard, former National Institutes of Health Director Francis Collins said at an event last year. Authorities focused on ways to stop the disease and failed to consider “this actually, totally disrupts peoples’ lives, ruins the economy and has many kids kept out of school,” Collins said. In October 2023, 27% of Americans who responded to a Pew Research Center poll said they had little to no trust in scientists to act in the public’s best interests, up from 13% in January 2019.

Nicaragua’s Ortega proposes reform to make him and his wife ‘copresidents’ (AP) Nicaragua’s President Daniel Ortega on Wednesday proposed a constitutional reform that would officially make him and his wife, current Vice President Rosario Murillo, “copresidents” of the Central American nation. While the initiative has to pass through the country’s legislature, Ortega and Murillo’s Sandinista party control the congress and all government institutions, so it is likely to be approved. The proposal also looks to expand the presidential term to six years from five. Ortega put forward another bill Wednesday that would make it illegal for anyone to enforce sanctions from the United States or other foreign bodies “within Nicaraguan territory.” Nicaragua’s government has imprisoned adversaries, religious leaders, journalists and more, then exiled them, stripping hundreds of their Nicaraguan citizenship and possessions. Since 2018, it has shuttered more than 5,000 organizations, largely religious, and forced thousands to flee the country.

Residents in Haiti’s capital stand with police in a battle to repel gang attack (AP) Gangs launched a new attack on Haiti’s capital early Tuesday, targeting an upscale community in Port-au-Prince where gunmen clashed with residents who fought side by side with police. At least 28 suspected gang members were killed and hundreds of munitions seized, according to Lionel Lazarre, deputy spokesman for Haiti’s National Police. The turmoil in Port-au-Prince deepened late Tuesday, when Doctors Without Borders announced it was suspending critical care across the capital as it accused police officers of violence and threats against its staff, including rape and death. The aid group will halt patient admissions and transfers to its five medical facilities, a blow to a country with extremely limited medical care. MSF said one of its ambulances was attacked by police last week, resulting in the killing of at least two patients and physical harm to its staff. The aid group reported four other recent violent incidents in one week alone, including one in which it accused an officer of saying that police would start executing and burning its staff, patients and ambulances.

Swooping In On The Lame Duck (AP/Reuters) As the Biden White House enters its lame-duck phase, China is looking to capitalize on the U.S.’s shaky diplomatic standing. At the recent G20 summit in Rio de Janeiro, Chinese President Xi Jinping shook hands with Argentinian President Javier Milei and Brazilian President Luiz Inacio Lula da Silva, securing deals with two of the most important leaders in South America. Meanwhile, Xi and Lula agreed that the China-Brazil relationship had become a “Community with a Shared Future for a More Just World and Sustainable Planet”—Chinese government jargon for “best buds.” On top of that friendship announcement, the pair announced 40 cooperation agreements across various sectors to drive over $150 billion in bilateral trade between their two countries.

Landmines in Ukraine (1440) President Joe Biden announced yesterday the US will send antipersonnel landmines to Ukraine, reversing a ban in place since 2022. Officials suggested the devices will shore up Ukraine’s defenses against Russia’s deployment of small squads across its lines; rights groups say the mines will endanger civilians. More than 160 countries are signatories to the 1997 Ottawa Convention banning the mines designed to detonate on contact. Russia and the US are not party to the treaty, with Russia deploying mines since the start of the conflict. Ukraine—a signatory—manufactures them.

Ukraine says Russia launched an intercontinental missile in an attack for the first time in the war (AP) Ukraine says Russia launched an intercontinental ballistic missile overnight targeting Dnipro city in the central-east of the country, which, if confirmed, would be the first time Moscow has used such a missile in the war. In a statement Thursday, Ukraine’s air force did not specify the exact type of missile, but said it was launched from Russia’s Astrakhan region, which borders the Caspian Sea. It said an intercontinental ballistic missile was fired at Dnipro city along with eight other missiles, and that the Ukrainian military shot down six of them. While the range of an ICBM would seem excessive for use against Ukraine, such missiles are designed to carry nuclear warheads, and the use of one would serve as a chilling reminder of Russia’s nuclear capability and a powerful message of potential escalation.

ICC arrest warrants (BBC) The announcement of arrest warrants by the International Criminal Court (ICC) for Israel's Prime Minister Benjamin Netanyahu and former Defence Minister Yoav Gallant has triggered a furious response in Israel. Hamas has welcomed the decision, without commenting on the warrant for its own military commander, Mohammed Deif. The announcement is a major blow to Israel’s international standing, to the two individuals named, and most specifically to Israel’s ongoing efforts to present its military campaign in Gaza as a fight between the forces of good and evil. Israelis are appalled that, in their eyes, the world seems to have already forgotten or overlooked the atrocities committed by Hamas on 7 October last year. Palestinians, especially Gazans, feel vindicated that their accusations of Israeli war crimes have now been echoed by an international body with some weight. But international lawyers have expressed doubts over whether either Netanyahu or Gallant will ever be brought to The Hague for trial.

Gaza death toll nears 44,000 (ABC News) After ordering policies leading to the displacement of 90% of all Gazans, the deaths of almost 44,000 people (70% of them women and children), and the destruction of 80% of the area’s health facilities, Israeli Prime Minister Benjamin Netanyahu finally stepped foot in the Palestinian enclave, where he recorded a video telling Palestinians that the IDF would hunt down and kill anyone who harmed the Israeli hostages and offered a $5 million bounty for the return of each hostage.

Virtually no aid has reached besieged north Gaza in 40 days, UN says (BBC) Palestinians are “facing diminishing conditions for survival” in parts of northern Gaza under siege by Israeli forces because virtually no aid has been delivered in 40 days, the United Nations has warned. The UN said all its attempts to support the estimated 65,000 to 75,000 people in Beit Hanoun, Beit Lahia and Jabalia this month had been denied or impeded, forcing bakeries and kitchens to shut down. Earlier this month, a UN-backed assessment said there was a strong likelihood that famine was imminent in areas of northern Gaza. Hundreds of people have been killed and between 100,000 and 130,000 others have been displaced to Gaza City, where the UN has said essential resources like shelter, water and healthcare are severely limited. Meanwhile, the US vetoed a draft UN Security Council resolution that demanded an immediate ceasefire between Israel and Hamas in Gaza. The 14 other Security Council members voted in favour, but the US said the text did not explicitly call for the immediate release of the hostages being held by Hamas as part of a ceasefire.

How Students Can AI-Proof Their Careers (WSJ) The current generation of college students is facing a challenge that those who came before never had to worry about: They’ll be competing with AI for jobs. What can they do to get ready? One consensus: It’s important to master skills not easily matched by machines, such as human-style communications and the ability to understand and work smoothly with people who have different perspectives and personalities. “In many ways the human skills are going to be more fundamental than they are now,” as machines take over some routine tasks, says Joseph E. Aoun, president of Northeastern University. A survey of 255 employers by the National Association of Colleges and Employers last year found that the three top “competencies” they sought in job candidates were communication, teamwork and critical thinking. Communication and teamwork rely on emotional intelligence, or EQ. “AI has probably won the IQ battle,” says Tomas Chamorro-Premuzic, chief innovation officer at Manpower Group and professor of business psychology at Columbia University, “but the EQ battle is up for grabs.”

Duct-taped banana artwork fetches US$5.2m at New York auction (Guardian) Maurizio Cattelan’s viral artwork was bought by Chinese-born crypto entrepreneur Justin Sun on Wednesday evening at Sotheby’s New York, besting initial estimates of between $1 million and $1.5 million. “I never thought I’d say ‘$5 million for a banana,’” the auctioneer quipped as the bid was approaching its climax. Sun said he plans to eat the banana “as part of this unique artistic experience.”

0 notes

Text

Sand Control Systems Market Overview, Size, Share, Trend and Forecast to 2033 | Market Strides

Sand Control Systems Market

The Global Sand Control Systems Market size is projected to grow at a CAGR of XX% during the forecast period.

The Global Sand Control Systems Market Research Report provides a comprehensive evaluation of the present industry scenario and future growth prospects over the forecast period. The research report analyzes and summarizes all important aspects of the market including technological evolution, recent industry trends and competitive landscape, market segmentation and key regions.

Research Methodology

Our research methodology constitutes a mix of secondary & primary research which ideally starts from exhaustive data mining, conducting primary interviews (suppliers/distributors/end-users), and formulating insights, estimates, growth rates accordingly. Final primary validation is a mandate to confirm our research findings with Key Opinion Leaders (KoLs), Industry Experts, Mining and Metal Filtration includes major supplies & Independent Consultants among others.

The Global Sand Control Systems Market Report provides a 360-degree view of the latest trends, insights, and predictions for the global market, along with detailed analysis of various regional market conditions, market trends, and forecasts for the various segments and sub-segments.

Get Sample Report: https://marketstrides.com/request-sample/sand-control-systems-market

List Of Key Companies Profiled:

ABB

Siemens

Horiba

Sick

Beijing SDL Technology

Focused Photonics

Emerson Electric

CECEP Talroad

Shimadzu

SEGMENTATION

By Type

Gravel Pack

Frac Pack

Sand Screens

Inflow Control Devices

Others

By Application

Onshore

Offshore

Get In-Detail : https://marketstrides.com/report/sand-control-systems-market

Sand Control Systems Market Regional Insights

North America

United States: The U.S. economy has shown resilience post-pandemic but faces inflationary pressures, particularly in housing and consumer goods. The Federal Reserve's interest rate policies remain a focus, as the balance between controlling inflation and avoiding recession has impacted spending, borrowing, and business growth. Key sectors like tech, finance, and renewable energy are experiencing dynamic changes, with AI, fintech, and green technology receiving heavy investments.

Canada: Economic stability remains a hallmark of Canada’s economy, although housing affordability and household debt are pressing issues. Canada continues to emphasize a green energy transition, investing in hydroelectric, wind, and solar power. The nation is also focused on attracting skilled labor, especially in technology, healthcare, and energy, as part of its economic strategy.

Mexico: Mexico has benefited from a nearshoring trend, as companies look to relocate manufacturing closer to the U.S. market. With a strong trade relationship via USMCA (the U.S.-Mexico-Canada Agreement), Mexico is seeing investments in its automotive, aerospace, and electronics industries. However, inflation, interest rates, and a need for infrastructure development remain areas of focus.

Buy Now : https://marketstrides.com/buyNow/sand-control-systems-market?price=single_price

FAQ

+ What are the years considered for the study?

+ Can the report be customized based on my requirements?

+ When was the Research conducted/published?

+ What are the mixed proportions of Primary and Secondary Interviews conducted for the study?

+ When will the report be updated?

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬

Market Strides is a Global aggregator and publisher of Market intelligence research reports, equity reports, database directories, and economic reports. Our repository is diverse, spanning virtually every industrial sector and even more every category and sub-category within the industry. Our market research reports provide market sizing analysis, insights on promising industry segments, competition, future outlook and growth drivers in the space. The company is engaged in data analytics and aids clients in due-diligence, product expansion, plant setup, acquisition intelligence to all the other gamut of objectives through our research focus.

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬: [email protected]

0 notes

Text

Support a Bold Vision for the Future of Energy Innovation

The Global Landscape of Energy: Trump, USA, Germany, and Canada’s Role in Shaping the Future

In today's world, the energy sector is one of the most crucial drivers of economic growth, technological innovation, and geopolitical influence. Countries like the United States, Germany, and Canada are at the forefront of this transformation, each playing a pivotal role in how energy is produced, consumed, and shared globally. Additionally, the leadership of former President Donald Trump has significantly impacted the United States' energy policies, affecting both domestic and international landscapes. This article delves into the key dynamics of Trump energy policies, USA energy strategies, and the energy frameworks of Germany and Canada.

Trump Energy Policies: Shaping the U.S. Energy Future

Under the leadership of Donald Trump, the United States experienced significant shifts in energy policies. Trump’s administration focused on reducing government intervention in the energy market, championing deregulation, and expanding fossil fuel production. One of his key moves was to withdraw from the Paris Climate Agreement, a decision that emphasized his stance on prioritizing domestic energy development over international climate commitments.

The Trump energy agenda was defined by an "America First" approach that encouraged the production of coal, oil, and natural gas. His policies sought to increase the nation’s energy independence by removing barriers for energy companies. This included easing environmental regulations for oil drilling, coal mining, and natural gas extraction. The administration also promoted the development of pipelines, such as the Keystone XL pipeline, which would transport oil from Canada to the U.S. This was in stark contrast to the environmental policies of his predecessors, which had focused more on renewable energy development and stricter emissions controls.

While Trump's energy policies were hailed by some for boosting U.S. energy production and creating jobs in the fossil fuel sector, they were criticized by others for their environmental implications. Critics argue that the focus on traditional energy sources undermined efforts to combat climate change and transition to cleaner, renewable energy solutions. Nonetheless, Trump's stance on energy undoubtedly shaped the landscape of U.S. energy production and consumption during his tenure.

USA Energy: A Diverse and Evolving Landscape

The energy landscape in the United States is as complex and diverse as the nation itself. The U.S. is one of the largest producers and consumers of energy globally, with a mix of fossil fuels, renewables, and nuclear energy forming the backbone of the energy sector. The nation has made significant strides in renewable energy, particularly solar and wind power, over the past two decades.

Despite the push for renewables, fossil fuels remain the dominant energy source in the U.S. Natural gas has become the primary energy resource due to advances in hydraulic fracturing (fracking), which has unlocked vast reserves of shale gas. The U.S. is now one of the world’s largest producers of natural gas, and this has had far-reaching effects on both domestic energy security and international trade.

At the same time, renewable energy in the U.S. continues to grow. Wind power, especially in states like Texas and Iowa, has seen substantial investments, while solar power has experienced exponential growth, thanks to federal tax incentives and decreasing technology costs. The Biden administration has placed a strong emphasis on decarbonizing the energy sector and increasing the adoption of electric vehicles, renewable energy sources, and energy efficiency technologies.

As the U.S. moves toward a more sustainable energy future, balancing the interests of fossil fuel industries with the demands of environmental policy remains a delicate challenge.

Germany Energy: A Pioneering Green Energy Model

Germany has long been a global leader in renewable energy, and its “Energiewende” or energy transition strategy has been a model for many nations looking to reduce carbon emissions and shift to sustainable energy sources. Germany's energy landscape is defined by its commitment to phasing out nuclear energy and dramatically increasing the use of wind, solar, and other renewable sources.

In 2011, following the Fukushima disaster in Japan, Germany made the bold decision to shut down all of its nuclear power plants by 2022. This decision prompted a major shift toward renewable energy sources, including wind, solar, and biomass. The country has become one of the world’s top producers of wind energy, with both onshore and offshore wind farms playing a significant role in its energy mix.

Germany’s commitment to reducing carbon emissions has spurred significant investments in green technologies. In 2020, over 45% of the country’s electricity was generated from renewable sources, making it one of the top countries globally in terms of renewable energy production. However, the transition has not been without challenges. The high cost of renewable energy infrastructure, as well as intermittent power generation from wind and solar, have posed obstacles. Nonetheless, Germany’s energy transition remains a cornerstone of its energy policy, with the country aiming to achieve carbon neutrality by 2045.

Canada Energy: Balancing Fossil Fuels with Sustainability

Canada’s energy sector is deeply intertwined with its vast natural resources. As one of the world's largest producers of oil, Canada’s energy sector is heavily reliant on fossil fuels, particularly oil sands in Alberta. However, Canada is also a global leader in hydropower generation, with renewable energy accounting for a significant portion of its energy mix.